In mid-April, we introduced a strategy that can help you find profits in any market environment. We call this strategy “Kinetic VQ.” The idea behind the strategy is simple.

As we said back then, this strategy is like a bloodhound sniffing out concentrated profit opportunities in the market. But instead of tracking a literal scent (like bloodhounds do so well), it tracks down constructive changes in volatility.

Here is how the strategy works, in a nutshell:

- Search for stocks that have a higher current Volatility Quotient (VQ) than their long-term Average VQ; and

- The stock is in the Stock State Indicator (SSI) Green Zone.

Why does this strategy work?

You’ve probably heard the saying that “bull markets climb a wall of worry.” Well, the same thing is true of individual stocks.

When a stock has a higher current VQ than its historical average VQ, it’s an indication that there is extra “worry” built up in the stock.

When that same stock starts a new uptrend, that extra worry acts like rocket fuel for the ensuing uptrend.

It’s really as simple as that.

That’s the beauty of the Kinetic VQ strategy. Kinetic energy is the force required to accelerate an object from a state of rest up to a given velocity.

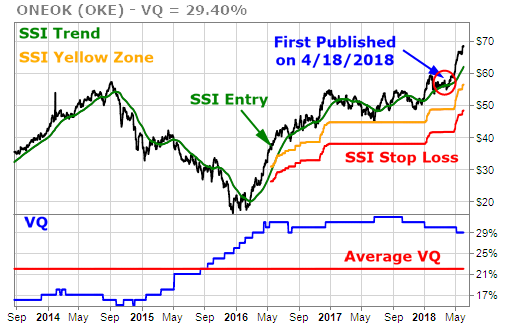

Oneok (OKE) is among the first examples we gave of a kinetic situation. The VQ began moving above its historical average in 2016. Shortly thereafter, OKE triggered an SSI Entry signal. At the time, the stock was under $40 — and at this time, it’s close to $70.

OKE has shot to new highs and is more than 12% higher than when we first presented it to you.

Identifying stocks that fit the Kinetic VQ is not hard, but if you need any assistance, my Customer Success Team wrote up a nice educational blog post on the steps needed to take within TradeStops. While we make it easy to see which stocks you own and are watching qualify within TradeStops, Ideas by Tradesmith scans through our entire dataset to identify stocks you may not know about.

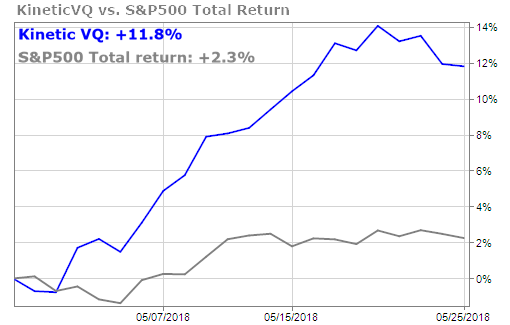

Since we began showing these Kinetic VQ stocks on our new Ideas by Tradesmith program, they have greatly outperformed the market. In just five weeks’ time, the Kinetic VQ stocks are up almost 12%, crushing the S&P 500, which is up just 2.3% in the same timeframe.

Tenet Healthcare (THC) is a recent example of a Kinetic VQ stock on Ideas by TradeSmith. The average VQ of THC is 31.3%. The VQ, when it triggered the entry signal, was 41.0%. Today, the VQ is 41.6%. THC has moved higher by 40% and is trading close to $35.50.

The Kinetic VQ strategy does not favor any particular area of the market — it just goes to where the potential profits are.

It’s designed to help you find those stocks exactly… and thus find the most attractive areas of the market… regardless of what the overall market is doing.