The U.S. economy is looking stronger by the day, and so is the U.S. dollar. This is good news for small-cap stocks and bad news for the rest of the world.

In April we said “The Market is Telling Us The Trade War Threat is Real.” The evidence of this was the outperformance of small-cap U.S. stocks versus large caps.

Small-cap stocks are more “domestic” and rely less on international revenues for profits. Large caps are more international, which means their business is hurt more by tariffs or potential trade war.

When small caps started outperforming large caps this late in the business cycle, we knew something strange was happening. Trade war fears were giving an edge to domestic small caps.

The super-strong U.S. dollar is also a factor. We explained two years ago why weakness in the dollar was probably a bear trap. The dollar’s weakness in 2018 was another bear trap.

After starting off the year in bear mode, the dollar aggressively surged, breaking a downtrend line that was in place for more than year. This is also good for small caps (and not so great for large caps).

A rapidly strengthening dollar is good for small caps because of their domestic profits orientation. Small- cap stocks are not hurt by a strong dollar and may even benefit from lowered import costs.

Large-cap stocks, on the other hand, tend to see their profit outlooks fall when the dollar rises strongly. And large-cap stocks, because they are more international, feel more pain when there is a growth slowdown in the rest of the world.

That is exactly what is happening now. Investors are starting to worry about economic growth trends in Europe and various emerging markets. They are nervous about the possibility of slowdown, or even the possible return of a debt crisis.

Meanwhile the global economy is showing signs of softening, but the U.S. economy is not. The U.S. dollar is rising, and U.S. interest rates are rising because America’s economy is so strong. For example:

-

- U.S. home values are rising at their fastest pace in twelve years, with Zillow reporting year-on-year gains in all 50 states.

Freight costs are surging, and the U.S. is experiencing a shortage of truckers, due to a U.S. transportation boom.

The number of Americans on unemployment benefits is the lowest since 1973.

Factory workers are seeing faster wage growth.

U.S. consumer sentiment is at its strongest in 14 years.

All of this strong economic activity has investors convinced that interest rates will be going up, which is making them bullish on the U.S. dollar.

Rising interest rates in the U.S. aren’t good news for the rest of the world, though, because a stronger dollar and higher rates add pressure to countries whose economies aren’t as strong as America’s.

Rising interest rates have also sent home mortgage rates to seven-year highs. That is bullish news for regional banks (who we talked about last month) via higher profits on lending spreads.

Again, the weakness in the rest of the world (and fears of trade war) are a growing concern with the U.S. dollar rising. That is why the large-cap-dominated Dow and S&P 500 indices are still well off their highs, but the S&P 600 Small Cap Index is at new all-time highs (as the chart shows below).

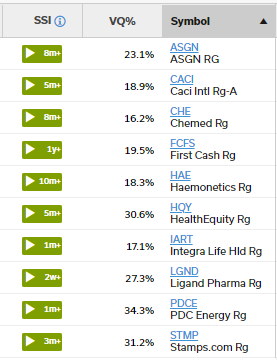

As another vivid illustration of investor sentiment, take a look at the top ten holdings of the S&P 600 Small Cap Index. You might notice something: They are all green.

There are real concerns for the health of the overall market right now. With that said, it’s clear small caps are the winners in this environment.

The U.S. domestic economy is humming and almost on the verge of running hot. Domestic-oriented names are better positioned to avoid trade war fallout. And the rising U.S. dollar is bad news for international profit outlooks, but not for local ones.

All of that combined is driving the outperformance of small caps.