In recent months we’ve been relentlessly bullish on energy stocks. Oil and gas names in particular look attractive, with an increased possibility of high and rising oil prices for years to come.

It was just this week that Brent crude, the international oil benchmark, topped $80 a barrel for the first time in years on concerns of turmoil in Iran and Venezuelan production collapse.

In markets, it can be said that “everything effects everything.” Prices are connected in surprising ways — like with the price of oil and solar stocks, for example.

If oil prices stay high for years, that means gasoline prices will likely stay high too. (Rising gasoline prices are already a “threat” to U.S. consumer spending, Reuters reports.)

If gasoline prices stay high, that could accelerate demand for electric cars — which in turn increases the demand for solar energy.

This possibility is bullish for solar stocks. Then too, a recent announcement from California was extremely bullish for the solar industry.

“California Becomes First State to Order Solar on New Homes,” Bloomberg reports. After the year 2020, most of the new housing in California will be mandated by law to have solar systems included, as part of the new standards adopted by the California Energy Commission.

All by itself, the state of California has the fifth-largest economy in the world. If California were a country, its GDP would be larger than Great Britain’s. And California is now mandating, by law, that future new homes have solar installed. That is a big deal.

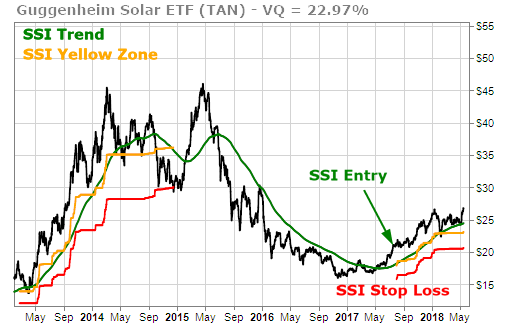

The bellwether instrument for the solar industry is TAN, the Guggenheim Solar ETF. If you look at the broad shape of the TAN chart below, you’ll see a rounded bottom pattern that has been developing for more than two years. The recent surge in TAN (on the California news) also pushed it above the 200-week moving average — a bullish sign.

TAN is quite strong in TradeStops, with a buy signal dating back to August of 2017. With the recent positive news out of California, bullish investor sentiment on TAN could be kicking into a higher gear.

A note of caution with TAN: The average trading volume for this ETF is lower than we’re normally comfortable with. We mention it here mainly because TAN is a recognized solar bellwether.

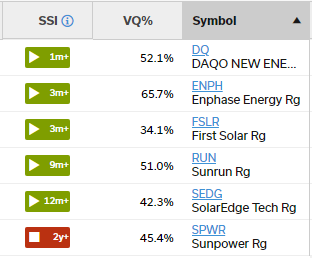

But some of the underlying names in TAN are quite liquid. For example, the biggest component is First Solar (FSLR), a prominent North American solar play. Here is a cross-section of some of the green solar names within TAN’s basket of holdings.

To recap, the whole solar industry is demonstrating a multi-year bottoming pattern… the TradeStops signals for TAN and many of the liquid top holdings in TAN are green… California (the world’s fifth-largest economy) just came out with hugely bullish solar news… and higher oil and gas prices can only be bullish for solar.

Overall, if you like energy stocks — and we certainly do — it’s hard not to like solar stocks here.