The stock market has at least three big problems right now. Those problems are:

- US dollar headwinds

- Rising interest rates

- The threat of more ETF-related blow-ups

The third problem is caused by the first two. I’ll explain why shortly.

But first, there is an open question of “what to do” in the stock market right now. The optimistic bulls are saying pay no attention to this recent volatility. They point out the fact that corporate earnings are strong, and the fact that the US economy appears healthy. That is their basic argument for staying in the market.

And to give the bulls credit, there are valid reasons to consider staying in the market. At a minimum, we can look to what’s happened in the recent past.

On at least nine separate occasions since 2009, there have been declines comparable to what we’ve seen in February 2018 – swift and sharp enough to make investors fearful. And yet the market came back each time, pushing on to higher highs. This could be just another one of those instances.

On the other hand, there are legitimate reasons for concern… and personally, I am very concerned. That is where our Stock State Indicators come in handy. If our SSI turns red and tell us to get out, we will happily listen to them because the danger here could be quite serious.

This goes back to what is happening with the US dollar and interest rates… and also the threat of more ETF blow-ups. Let’s talk about why.

The year 2017 was remarkable in many ways. Even as the world dealt with serious geopolitical threats (like escalation with North Korea), stocks were remarkably calm. In fact, 2017 was one of the calmest markets on record for stocks… going all the way back to 1964!

The S&P 500 also finished with gains in every single calendar month of 2017. That had never happened before – ever. You can see the lack of volatility in the S&P 500 chart below.

Nor was it just the S&P 500 or American stocks that saw low volatility and a steady drip higher. This remarkable sense of calm was present in stock markets around the world. It was calm and quiet everywhere.

You can see this via URTH, the iShares MSCI World ETF, which represents all the global indices.

Something else remarkable happened in 2017. The US dollar went down… and down… for almost the entire year straight. This was a bullish factor for stocks around the world.

When the US dollar declines, it becomes easier to borrow in US dollars. American multinationals tend to see stronger earnings when the dollar is weak. And US investors tend to buy more international assets, like emerging market equities and debt, when the dollar is falling. All of this is bullish for stocks – both at home and abroad. You can see the dollar’s fall via the chart below.

The problem now is if the dollar starts to rise instead of fall, the whole process will go into reverse. A rising dollar makes international assets less attractive. It makes it harder to borrow. And it hurts the earnings of US multinationals.

There is also a negative feedback loop here. When international stock markets decline, US investors tend to withdraw their capital and bring it back home. This adds to the strength of the dollar, which in turn makes global equities less attractive.

And right now, I’m very bullish on the US dollar. Here are a few of my reasons why.

The smart money is bullish on the greenback. You can see in the chart below what has happened every time that the net position of the commercial traders in the US dollar futures market has risen above the zero line.

Our time-cycles analysis of the dollar is also very bullish. The time-cycles have been remarkably accurate on the dollar for this whole bear market. That’s about to change.

I think that the implications of a rising US dollar are already starting to drive some of the recent market turmoil.

As you can see from the URTH chart we showed earlier, global equities have already begun to fall. This risks kicking in the negative feedback loop we just explained, where an oversold dollar starts to get stronger. If this trend reinforces itself, markets everywhere could fall further in a vicious cycle.

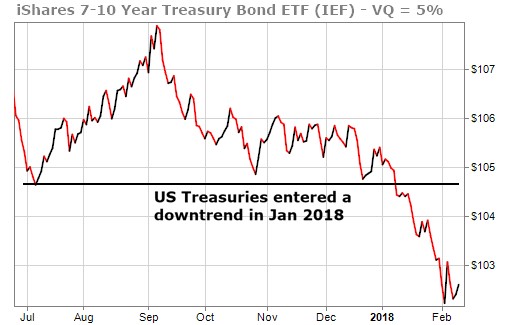

There is also rising concern in global bond markets. When bond prices go down, interest rates go up and vice versa. Lately US Treasury bond prices have fallen in a big way, as investors anticipate higher interest rates in 2018 (due to stronger US economic growth).

As the chart below shows, US Treasury bonds entered a downtrend in January 2018. This means interest rates are now going higher (because interest rates rise as bonds fall).

Rising interest rates are a serious worry for investors. When interest rates are low, the price of money is cheap, which makes it easy for companies to borrow and buy back shares. (Companies have borrowed huge amounts over the past nine years, to buy back shares and pay dividends.)

Low interest rates are also used to justify high stock market valuations. According to the cyclically adjusted price-to-earnings ratio, or CAPE, stock market valuations were recently at their third highest levels in history, behind only the peaks of 1929 and the year 2000.

When interest rates rise, monetary conditions tighten. The price of money stops being cheap, which makes it harder for companies and consumers to borrow. And it becomes harder to justify high stock market valuations, which thus increases the odds of a stock market decline.

You can see how interest rates have been rising in the chart below (once again, interest rates rise when bond prices fall). If the ten-year yield breaks above 3%, that would set off alarm bells for investors.

Last but not least, in the past week, we have seen blow-ups in exotic products like short volatility ETFs. One of the ugliest blow-ups was in XIV, which was actually an ETN or “exchange-traded note.”

Buying XIV was a way to bet against volatility. Because 2017 was the lowest-volatility year in more than half a century, XIV tripled in value over the course of 2017.

But then volatility came roaring back… and XIV lost nearly 97 percent of its value… in less than a week!

Credit Suisse, the investment bank responsible for issuing XIV, has announced they will be shutting it down. The last day of trading will be February 20th. It’s not hard to see why they are killing it. The product was a disaster.

It wasn’t just retail investors who lost huge amounts of money in “short volatility” products like XIV. There is a mutual fund out of Chicago, the LJM Preservation and Growth Fund, which reportedly lost 82 percent of its value in a matter of days.

You can be sure there are more volatility blow-ups we haven’t heard about. Some of them may be quite large, on the scale of hundreds of millions or even billions.

“Short volatility” was a hugely attractive trade, for both retail investors and institutions alike. Even state pension funds, which manage the retirements of teachers and firemen, were using short volatility strategies.

By some estimates the total size of the short volatility space, which goes far beyond ETFs, was as much as $2 trillion. There could be a lot of pain yet to come in this area… and more selling.

And even if we get past the short volatility ETFs, it is possible other ETF products could blow up in the coming weeks or months. We could see meltdowns in various high-yield debt ETFs, for example, which package illiquid assets like junk bonds and emerging market debt.

The risk with high-yield debt ETFs is what happens if too many investors hit the “sell” button all at once. These products have never been stress-tested for crisis conditions. As with XIV, we don’t know if these ETFs will be able to withstand a panic. And if just one high-yield debt ETF fails, there could be a run on all of them.

The reason that ETF blow-ups, rising dollar headwinds, and rising interest rates are all related is because dollar headwinds and rising interest rates put pressure on stretched asset valuations… which then increases volatility and selling pressure… which then leads to an increased possibility of meltdown.

The primary message is “be careful out there.” It isn’t necessarily time to get out of markets completely. But if our SSI indicators say get out, that signal should be honored. History and statistics show that’s a good idea regardless – but caution is especially warranted now.

The stock market could bounce back, as it has done many times over the past nine years. But we can’t assume that will happen. Dollar headwinds and rising interest rates are warning signs we should heed.

It’s definitely time to start taking a more defensive posture when it comes to stock market investing.