For the past few weeks, we’ve attempted to inspire you to capitalize on one of the biggest advantages you have over institutional investors – the ability to have a more concentrated equities portfolio.

Today, it’s time to get down to business and start the work of getting your portfolio into shape for 2018.

Speaking of getting down to business, the first line of attack in trimming down a portfolio should be to think like a business person. As investors, we are owners of businesses after all.

What’s the first rule of business? To make a profit! Businesses that don’t make a profit won’t be around for long.

There are various ways an investor might evaluate whether or not a business that he or she owns is making money. The simplest way, however, is to ask if the business has made you any money or not.

That’s exactly where we’ll start.

The Plan

For the purposes of this exercise we have put together a portfolio of just over 100 equities. We created the portfolio by taking the top 10 holdings of each of the 10 Select Sector SPDR ETFs.

Alright, so let’s get to work trimming it down!

As I mentioned above, our first step is to find out which businesses we own aren’t delivering the goods for us. We’ll sort the portfolio by gains (including dividends) and just throw the underperformers overboard.

Another step that you might consider is to add up the losses on the stocks that you sell and then sell just enough of the smallest gainers from your portfolio to offset the losers you got rid of.

This step can help with taxes from capital gains (but please consult your accountant to confirm). It’s also just another way to cull the poorest performing businesses from your portfolio.

The Result

Ok… now you’re hopefully down to a set of businesses that have done what businesses are supposed to do for their owners. They made you money.

Still, you may need to trim down your portfolio even more to end up in the 15 to 50 stock range that our research has indicated is most optimal for individual investors.

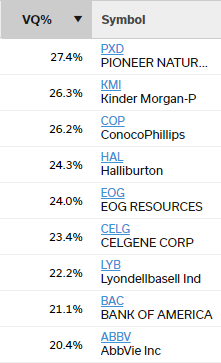

The next step would be to sort your remaining holdings by their Volatility Quotient (VQ) and consider getting rid of any businesses with a VQ over 50.

We’ve sorted our remaining winners here but because the portfolio was very conservative to begin with. We didn’t have any super-risky positions in the portfolio.

The Takeaway

After these two steps, our 100 stock portfolio has been trimmed by about 30% down to 70 or so stocks.

That’s probably enough work for this week.

Next week we’ll talk about how you can trim down your portfolio even more by looking at portfolio diversification and then finally your own personal preferences!

Wait a minute, did I really just say “personal preferences?” You betcha. More on that next week.