If it’s true that success leaves clues… could the world’s billionaires provide the key to the strongest market sectors to invest in?

Stock markets around the world keep posting all-time highs. That’s great, but it’s what’s happening beneath the surface that tells us a lot more.

The third quarter 13(f) filings of the billionaires just became available this week. That’s when we get a chance to learn what the billionaires did with their own money in the third quarter of 2017.

It’s a great chance to get a peek behind the proverbial curtain.

My team and I have been poring over this data, seeking insights to share with you that you can use to make smarter investment decisions and make more money. I think you’ll be interested in what we’ve found.

Talking-heads on the news report how many points up or down the market moves on any given day. But, what you don’t hear – what they’re not telling you, is how each sector moved. And how these sectors affect the overall market movement.

What The Billionaires are Buying

We’ll look now, at a couple of sectors the billionaires are buying. Right off the bat, we’ve identified three that warrant your attention.

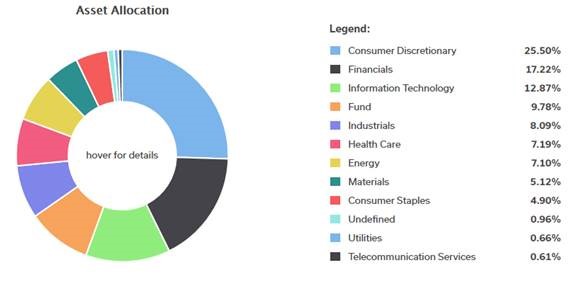

At the end of the second quarter, the billionaires had their biggest investments in the Consumer Discretionary sector. The second biggest investment was in Financials and the third was in Information Technology.

The billionaires had twice the amount of money invested in Consumer Discretionary than in Technology and 50% more invested than in the Financials.

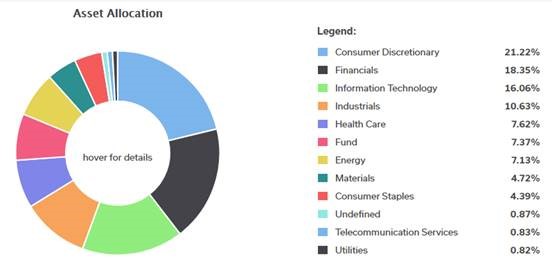

The third quarter saw quite a change.

Consumer Discretionary is still the top sector, but not by as much. For our first clue about where the billionaires are headed, let’s take a look at the remaining sectors.

The Data

Financials, Technology, and even the Industrials all gained ground from 2Q17 to 3Q17. Let’s take a look at each one in turn. To do so, we’ll use the relevant SPDR Sector Select ETFs.

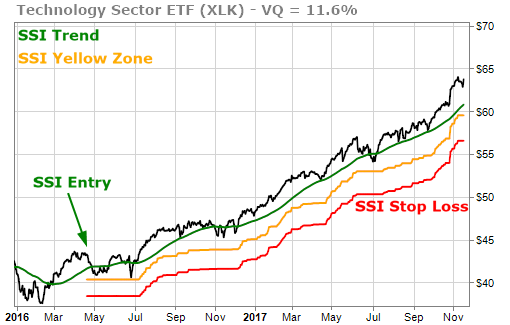

Of the three sectors in question, the chart of XLK, the Technology Sector Select ETF, is the strongest.

It’s been on quite a roll in the 18+ months since triggering a Stock State Indicator (SSI) Entry signal. It hasn’t even touched down into the SSI Yellow Zone during the entire move higher.

The chart of the Financials, though not as strong as the chart for Technology, is still looking good. XLF is the Financials Select Sector ETF.

XLF barely went down into the SSI Yellow Zone about 6 months ago, but never came close to stopping out.

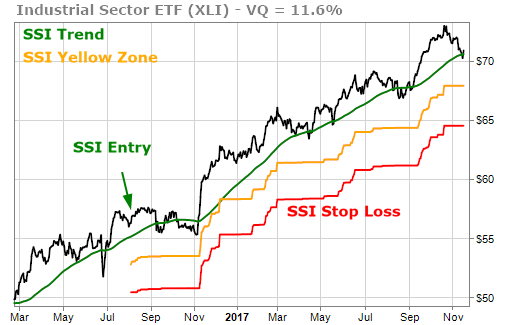

Finally, the Industrials, as represented by XLI, the Industrial Select Sector ETF, also have a very strong chart. Since triggering an SSI Entry signal more than a year ago, it hasn’t come close to hitting the SSI Yellow Zone.

The Takeaway

The billionaires have been increasing their holdings of the strongest sectors. It’s interesting to note that they’re buying more of what’s already working rather than trying to find the next “bargain” that may or may not be forming a bottom.

We’ll continue to x-ray their portfolios and share these kinds of insights in the weeks and months to come.