Last week we continued digging into our new billionaire data set and I used that data to argue that the TradeStops Risk Rebalancer was the most powerful tool in the TradeStops toolbox.

You might be inclined to disagree with my claim after you see how much value the TradeStops Stock State Indicator could have added to the billionaires’ bank accounts.

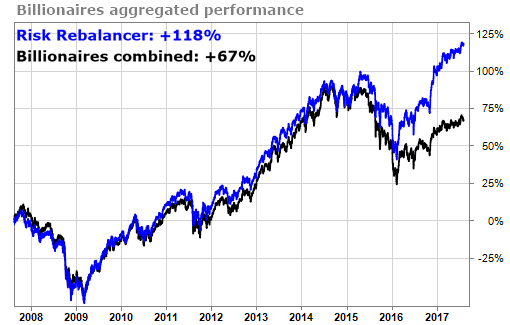

Here’s where things stood last week…

We looked at the aggregated performance of a dozen of the world’s leading investors including big risk seekers like Bruce Berkowitz and John Paulson as well as more conservative investors like Warren Buffett and Bill Gates. In this particular study we gave each billionaire equal weight. Berkowitz counted just as much as Buffett.

We found that over the past 10 years, the collective performance of these billionaires netted out to 67% gains. (FYI, that is about in line with the performance of the S&P 500 index over the same period.) Then we looked at how our equal-risk approach to position sizing nearly doubled that performance.

Here’s the chart from last week:

I’m always amazed when I see how much value is gained by putting more money into less risky stocks and less money into more risky stocks. The only difference between the blue line and black line is the amount of money invested in each stock!

The stock picks are exactly the same. The entry dates AND exit dates are exactly the same. Just changing the amount invested nearly doubled the performance.

Wow.

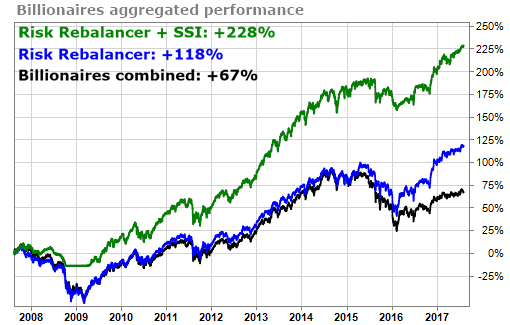

Now let’s take a look at how much value we get from adding the TradeStops Stock State Indicator (SSI) system to the billionaire stock picks. Hold on to your hats…

How did we get that green line exactly? Here are the rules:

- Start with the investment ideas of 12 billionaire investors

- Apply equal risk position sizing to each billionaire’s portfolio so that more money goes into less risk stocks and less money goes into the more risky stocks. (You can do this on an entire portfolio with one click using the TradeStops Risk Rebalancer.) Now you’ve got the blue line in the chart above.

- Use the TradeStops Stock State Indicator system to stay out of ANY billionaire investment ideas that are in the SSI Red Zone.

Frankly I was surprised to see how much extra value the SSI added to these results. I wasn’t expecting it. In looking into the data, there are a couple of reasons that the SSI had such a big positive impact on the collective performance of the billionaires.

One of the big reasons is that when the billionaires fail, they tend to fail spectacularly. Bruce Berkowitz lost 25% of his portfolio on Sears Holding. Bill Ackman rode Valeant Pharmaceuticals for a 90% loser. The billionaires tend to be high conviction investors and sometimes those high convictions can be devastating.

So… can I really argue that the TradeStops Risk Rebalancer is the most powerful tool in the TradeStops toolbox when the Stock State Indicator added even more juice to the billionaires’ performance?

The reason that I argue that equal risk position sizing is the most important tool in the TradeStops toolbox is because I consistently see performance improvement from it across nearly all portfolios I study – from novice investors to world-class investors.

The billionaire investors, however, are better than most of the rest of us at deciding how much money to put into each investment. They’re not perfect by any stretch but, believe it or not, the impact of improved position sizing is even stronger on most novice investors.

If you wanted to make a case that the TradeStops SSI is even more powerful than the TradeStops Risk Rebalancer, I’d have a pretty hard time defending myself.

Let’s just use them both and be done with it.