Buffett’s Big Moves

Last week, we got our first glimpse of the second quarter SEC filings for Warren Buffett and other big investors. Based on the second quarter filings of Berkshire Hathaway, it sure looks as if Warren Buffett has been following TradeStops.

About 45 days after the close of each quarter, institutional investment managers with over $100 million in qualifying assets must file a 13F form with the SEC to let us all know what they bought and sold.

Second quarter SEC filings for Warren Buffett

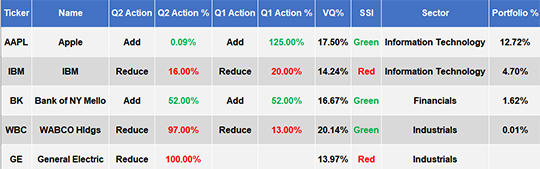

The following table shows the biggest changes that Buffett made in the Berkshire Hathaway portfolio over the past two quarters. You can see the “Q2 Action” and “Q1 Action” columns below. If the values are green then Buffett added to the position. If they are red then it means that he reduced the position.

We’ve also included a TradeStops SSI column to show you whether or not our current Stock State Indicator system is green or red for the same position.

Out of Buffett’s five biggest moves, he’s in agreement with TradeStops 80% of the time (4 out of the 5).

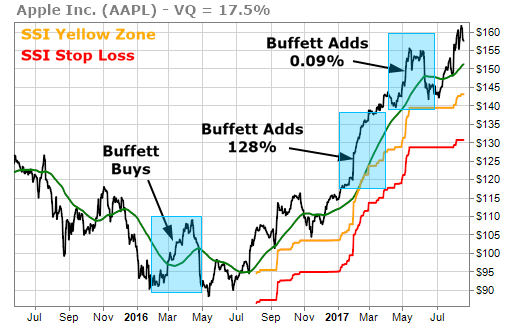

Buffett’s biggest move was in Apple (NASDAQ: AAPL). We wrote about Buffett’s big add to his Apple position not too long ago. We’re big believers in Doubling Up on Your Winners and Buffett has done just that.

His big purchase of AAPL came in the first quarter of 2017 as he more than doubled up on his position. It looks like his 2Q buys were likely just final orders trickling in from his big 1Q add. Apple is now Buffett’s third largest holding behind Kraft Heinz (NASDAQ: KHC) and Wells Fargo (NYSE: WFC).

Buffett and The Bank of New York Mellon

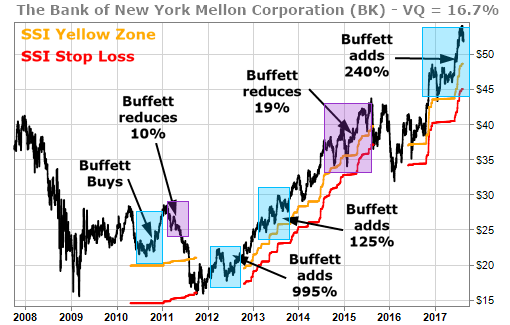

Buffett’s other big add in the first half of 2017 was The Bank of New York Mellon (NYSE: BK).

Buffett began accumulating shares of BK more than seven years ago. He’s traded out of some of these shares along the way, but has always bought more when the opportunity presented itself.

Beginning in the third quarter of 2016, he has increased his position in BK by nearly 2.5 times.

Here’s a chart highlighting Buffett’s moves in BK over the years. Blue boxes highlight Buffett’s buys. Purple boxes highlight his sells.

His purchases of BK in 2010 and 2012 were made at almost the same time that BK triggered Stock State Indicator (SSI) Entry signals.

His BK purchase in 2013 looks very much like another “Doubling Up on Your Winners” trade. It’s easy to see that Buffett is not afraid to buy a stock that’s moving higher and performing well.

His BK sales in 2011 and 2014-15 were near the end of the stock’s run higher and the stock sold off both times after he sold shares. I don’t know about you but I had no idea that Buffett was such a good market timer!

I, for one, will be keeping a closer eye on stocks that Buffett appears to be trading in and out of going forward.

Finally, it’s great to see that in 2017 Buffett has once again more than doubled up on a winning position… but this time at 10 year highs.

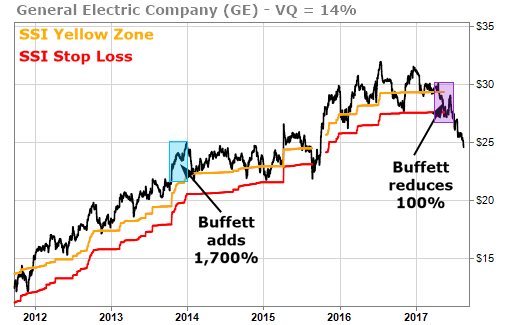

On the red side of the ledger, Buffett completely closed out his position in General Electric (NYSE: GE)… at almost the exact same time as GE entered the TradeStops SSI Red Zone.

Even GE’s almost 4% dividend yield wasn’t enough for Buffett to stay in the position. And the stock has continued to move substantially lower, down almost 10% since triggering its SSI Stop Signal.