This Could Be the Year Big Business Goes Remote (and stops shaking hands)

The coronavirus outbreak may now be “at the brink” of a global pandemic. So says Anthony Fauci, the director of the U.S.-based National Institute of Allergy and Infectious Diseases, as reported by Axios.

The virus, officially dubbed COVID-19, has killed more than 2,000 people and infected more than 75,000 within China — assuming numbers from the Chinese government are trustworthy. If not, the true tally could be far worse.

Outside China, there have only been five reported deaths as of February 2020. But there are 800 cases across 28 countries and territories, with increasing evidence that “asymptomatic” carriers — those who have the virus but show no symptoms and don’t realize it — are infecting others.

Based on World Health Organization (WHO) data gleaned from 44,000 China cases, 14% of coronavirus victims have “severe disease-like pneumonia and shortness of breath,” according to Axios. Another 5% “come down with a critical disease like sepsis, multi-organ failure, and respiratory failure,” and 2% die.

This is not just a variant of run-of-the-mill flu.

It remains unclear what happens next. As we noted last week, large multinational businesses are starting to cancel international events. Global supply chains are shutting down, factories grinding to a halt.

In terms of investor sentiment, two possible tipping points — events that could end the market’s complacency — are the declaration of a global pandemic, and a string of severe precautionary measures taken by Western governments.

For Westerners, the coronavirus may not feel “real” when headlines and crisis events are related to places halfway around the world. That could change if lifestyle restrictions show up on Western doorsteps.

Without making light of this crisis — and in China, it is already a crisis of full-blown proportions — it is interesting to wonder which company, or industry, might see the greatest long-term gain from the coronavirus outbreak, or from pandemic conditions in general.

Even if the outbreak is contained and extinguished six months from now — and it may not be — there will be another at some point. For example: The global overuse of prescription antibiotics, plus dangerous conditions in hospital wards and industrial-strength levels of antibiotics in animal feed, means another “superbug” will break out sooner or later (hopefully later).

Did you miss this free stock pick?

If you skipped the 2020 Melt Up Event, watch by tomorrow. You’ll hear Dr. Steve Sjuggerud’s insane prediction about where this bull market is heading next. Plus, you’ll hear about the 9 stocks Steve believes should be on everyone’s radar by tomorrow’s opening bell, including the name and ticker of a small bio-tech stock with massive upside (completely free). Click here before tomorrow.

So, without being morbid, who benefits from this? Where will capital allocate itself in response to a rising 21st century pandemic threat?

The obvious answer would be biotech and pharma companies — the players on the front lines of creating new vaccines and finding new treatments.

But there is a better answer, tying into bigger markets with a trend that was already strong: The remote communications industry, with a possible extension into virtual and augmented reality technologies.

Morgan Stanley is a prime example of the shift we could soon see. The top-tier investment bank normally holds a high profile “Hong Kong investor summit” each year — but this year’s will be different.

“This time it is going to be a virtual event,” a Morgan Stanley spokesman told the Financial Times.

How does one hold a “virtual” conference in the first place? Will there be a virtual meet and greet? The equivalent of digital cocktail gatherings where the participants see each other as Brady Bunch heads on a screen? Avatars with customized outfits, bumping into other avatars in a virtual landscape?

There are lots of questions, but they will all eventually have answers. And if Morgan Stanley can hold a serious virtual conference, in which serious connections are made and serious business is done, any Fortune 500 company can do it. And if the big guys can do it, with the cost of cloud power and bandwidth falling rapidly, the little guys will soon enough do it, too.

It used to be that, to make an important introduction or handle a large transaction, a physical presence was required, or at least strongly encouraged. There is something meaningful about looking someone in the eye and shaking their hand.

But what happens when pandemic fears enter the equation?

At minimum, “virtual gatherings” of meaningful size and scope — like Morgan Stanley’s Hong Kong conference — will become more acceptable, or even normal. This is a pathway to making them routine. And once that’s the case, why travel as much? Why not stay home?

“Remote work,” also known as working from home, was already a thing for a growing percentage of knowledge workers. The coronavirus outbreak could make it a persistent worldwide trend, breaking down corporate resistance barriers that much further.

Sometimes a major event accelerates a paradigm shift. There is a certain way of thinking and behaving pre-event, and a different way of thinking and behaving post-event. The event is then marked as the point where the tide turned.

When this happens, there was typically some form of trend momentum prior to the event — but the event’s direct impact helped turn the probable into the inevitable, or otherwise sped up the timetable.

So it could be with remote work, virtual events, and a newfound fear of shaking hands with strangers.

If there is a single bellwether stock for this trend, it might be that of Zoom Video Communications (ZM), a company that provides high-quality video communication software (think digital conference calls).

If you search for the ticker, by the way, be sure to use ZM and not ZOOM. When Zoom had its hotly anticipated IPO in March 2019, some investors bought the wrong stock by mistake.

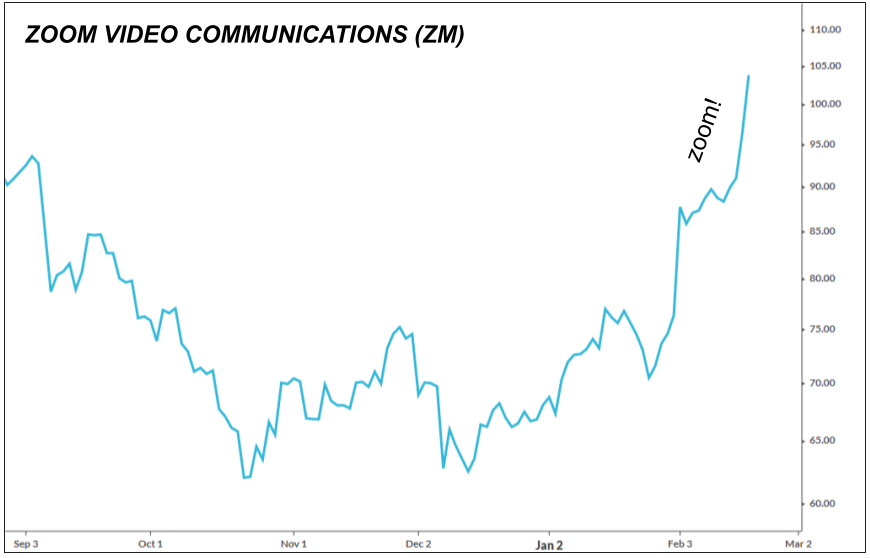

As you can see from the chart below, Zoom’s share price has, well, “zoomed” in recent weeks. Eric Yuan, the CEO-founder of Zoom, reported a few weeks ago — after a strong quarterly earnings report — that Zoom’s technology has seen record usage since the outbreak.

It’s hard to buy Zoom comfortably here because of the valuation: The company is trading at an eye-watering multiple of 290 times expected earnings. With that said, the future for Zoom, and the whole remote communications industry, is certainly bright.

And as the cost of technology falls, the remote communication possibilities will only grow more intriguing.

Imagine, for example, a remote communications center near your local company headquarters, or perhaps even close to your house.

You walk into a room and sit down at a beautiful oak table, and moments later colleagues from multiple cities, or even multiple countries, all materialize around that same table.

The experience is created with immersive video screens and room setups in each location that look exactly the same. For each person attending the meeting, the feeling of “being there” is almost indistinguishable from reality. The only thing you can’t do is shake someone’s actual hand.

But maybe, in a post-coronavirus world, you wouldn’t want to anyway.

TradeSmith Research Team